Irs Annual Limits 2024 – The parameters of this government largesse change annually. For 2024, the IRS only allows you to save a total of $7,000 across all your traditional and Roth IRAs, combined. This figure is up from the . Participating in a 401(k) through your employer can be a good way to contribute to and save for your retirement. One important thing to know is that there are limits on how much you can contribute .

Irs Annual Limits 2024

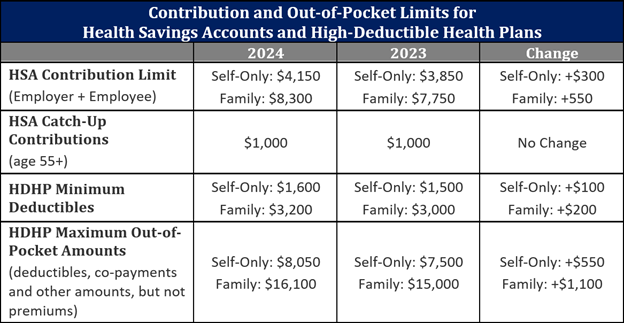

Source : www.captrust.comIRS Announces HSA and HDHP Limits for 2024

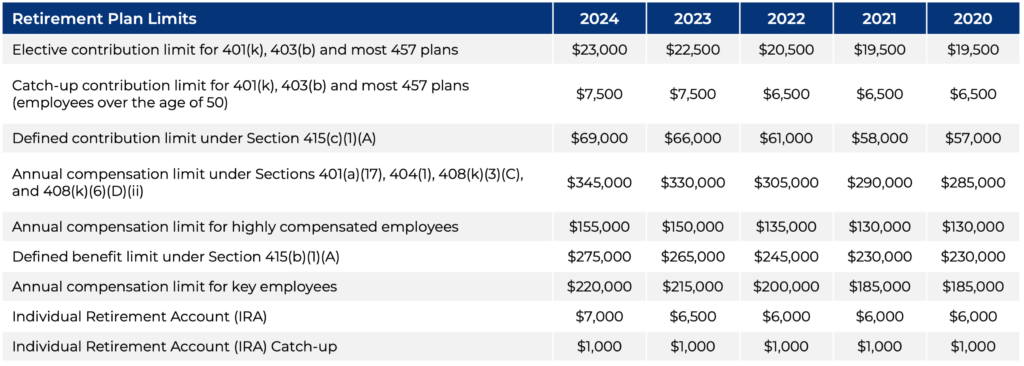

Source : www.keenan.comNew 2024 IRS Retirement Plan Contribution Limits [Including 401(k

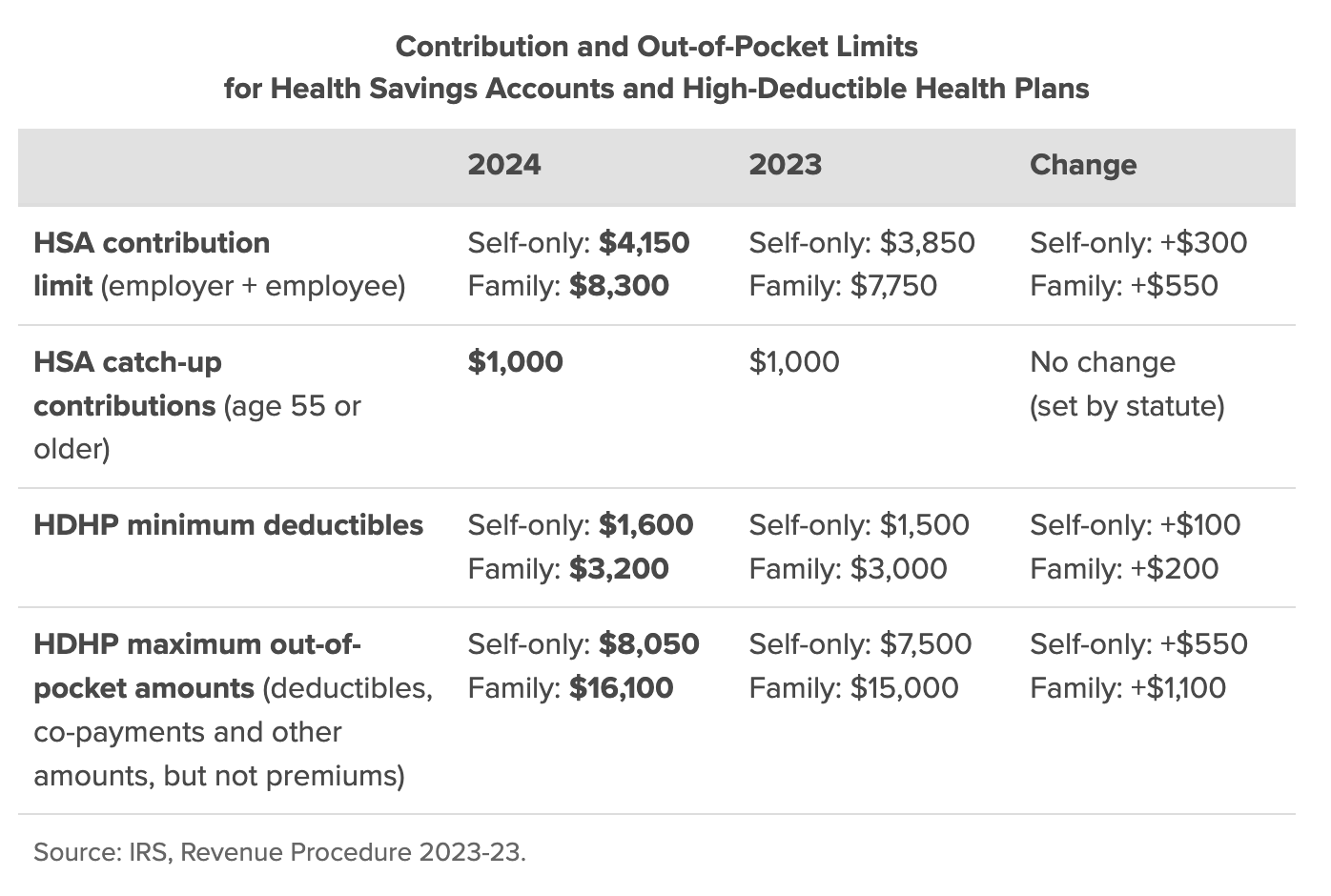

Source : www.whitecoatinvestor.comIRS Makes Historical Increase to 2024 HSA Contribution Limits

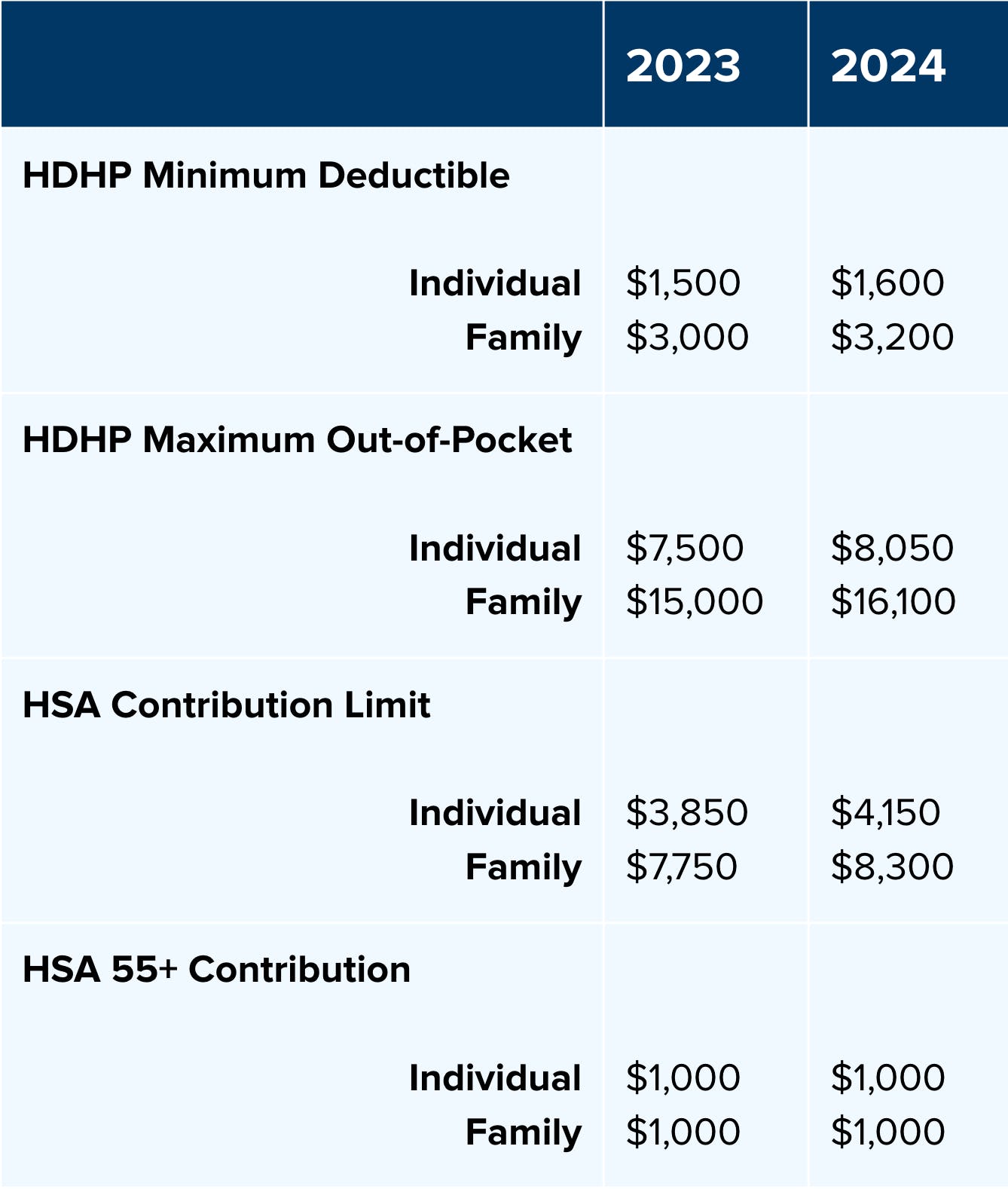

Source : www.firstdollar.com2024 HSA Contribution Limits Claremont Insurance Services

Source : www.claremontcompanies.comIRS Unveils Increased 2024 IRA Contribution Limits

Source : www.theentrustgroup.comIRS Annual Limits for Benefit Plans: 2024 Cost of Living

Source : www.usbenefits.lawIRS Announces 2024 Limits for Qualified Retirement Plans | Dykema

Source : www.dykema.comSignificant HSA Contribution Limit Increase for 2024

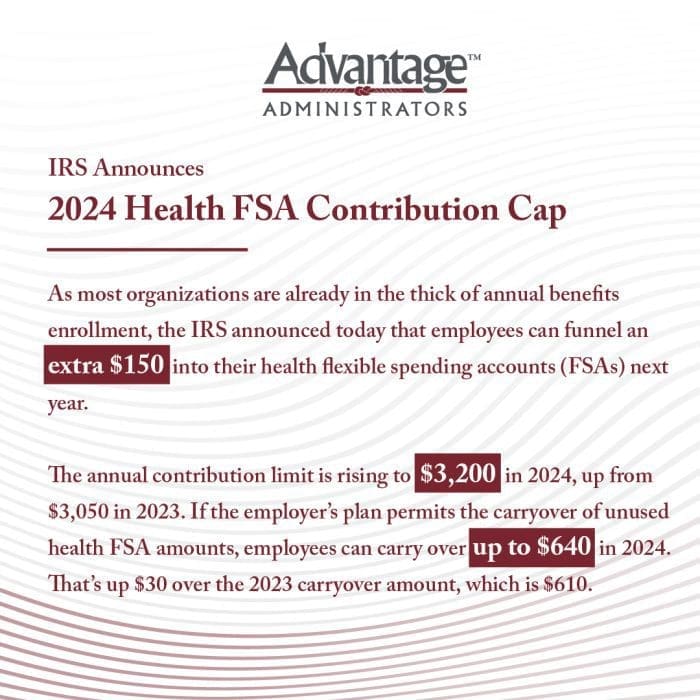

Source : www.newfront.comThe IRS Just Announced the 2024 Health FSA Contribution Cap!

Source : advantageadmin.comIrs Annual Limits 2024 IRS Announces 2024 Retirement Plan Limitations | Retirement Plans : It’s an unusual time of year for people who pay attention to their taxes—possibly catching you with two goals in mind. On the one hand, you’re worried about preparing and filing your tax return for . It’s nobler to give than to take, the saying goes, and giving assets to loved ones while you’re still alive is a great way for them to enjoy the benefits right away — and for you to delight in .

]]>